Bitcoin has been a hot topic in the world of finance, with its price constantly fluctuating. For those interested in tracking the price of Bitcoin, it's important to stay informed on the latest news and analysis. Here are four articles that will help you navigate the world of Bitcoin prices and make informed decisions about buying, selling, or holding onto your cryptocurrency investments.

Understanding the Factors Influencing Bitcoin Price Fluctuations

Bitcoin has become a widely discussed topic in the world of finance due to its volatile nature and unpredictable price fluctuations. Understanding the factors that influence the price of Bitcoin can be crucial for investors, traders, and policymakers alike.

One of the key factors that influence the price of Bitcoin is market demand. Just like any other asset, the price of Bitcoin is driven by supply and demand dynamics. When there is a high demand for Bitcoin, its price tends to rise, and vice versa. Factors such as market speculation, investor sentiment, and macroeconomic events can all impact market demand for Bitcoin.

Another important factor that influences Bitcoin price fluctuations is regulatory developments. As governments around the world continue to grapple with how to regulate cryptocurrencies, news of regulatory crackdowns or endorsements can have a significant impact on the price of Bitcoin. For example, when China announced a ban on cryptocurrency exchanges in 2017, the price of Bitcoin plummeted.

Furthermore, technological advancements and security concerns can also influence Bitcoin price fluctuations. Issues such as scalability, network congestion, and security breaches can all impact investor confidence in Bitcoin, leading to price volatility.

In order to better understand Bitcoin price fluctuations, it is important to consider factors such as market demand, regulatory developments, and technological advancements. By staying informed about these key

Analyzing the Historical Trends of Bitcoin Price Movements

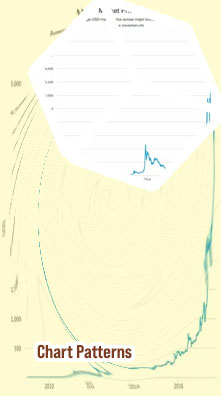

Bitcoin has been a hot topic in the financial world for the past decade, with its price movements captivating the interest of investors and analysts alike. By analyzing the historical trends of Bitcoin price movements, we can gain valuable insights into the factors that have influenced its volatility over time.

One key trend that has emerged from analyzing Bitcoin's price movements is its tendency to experience sharp fluctuations in value. This can be attributed to a number of factors, including market sentiment, regulatory developments, and macroeconomic trends. For example, the price of Bitcoin surged to an all-time high in late 2017, only to plummet dramatically in the following months.

Another important trend to note is the correlation between Bitcoin's price movements and broader market trends. During periods of economic uncertainty, investors have often turned to Bitcoin as a safe haven asset, driving up its price. Conversely, during times of market stability, the price of Bitcoin has tended to be more volatile.

Overall, analyzing the historical trends of Bitcoin price movements can provide valuable insights for investors looking to understand the underlying dynamics of the cryptocurrency market. By identifying key patterns and correlations, investors can make more informed decisions about when to buy or sell Bitcoin, ultimately maximizing their returns.

Strategies for Predicting Bitcoin Price Changes

Bitcoin has become a popular asset for investors looking to capitalize on its price volatility and potential for high returns. However, predicting Bitcoin price changes can be challenging due to the market's unpredictable nature. To help investors make informed decisions, there are several strategies that can be employed to forecast Bitcoin price movements.

-

Technical Analysis: This strategy involves analyzing historical price data, trading volume, and other market indicators to identify trends and patterns that may help predict future price movements.

-

Sentiment Analysis: By monitoring social media, news articles, and other sources of information, investors can gauge market sentiment and use this data to predict potential price changes.

-

Fundamental Analysis: This strategy involves evaluating the underlying factors that may influence Bitcoin's price, such as regulatory developments, macroeconomic trends, and technological advancements.

-

Machine Learning: Utilizing algorithms and statistical models, machine learning can be used to analyze large datasets and identify patterns that can help predict Bitcoin price changes.

-

Market Analysis: By studying market trends, investor behavior, and other factors that impact Bitcoin's price, investors can gain insights into potential price movements and make more informed investment decisions.

The Impact of Market Sentiment on Bitcoin Price Volatility

The volatility of Bitcoin prices has long been a topic of interest for investors, economists, and enthusiasts alike. One of the key factors influencing this volatility is market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset, in this case, Bitcoin.

-

Social Media: Social media platforms such as Twitter, Reddit, and Telegram play a significant role in shaping market sentiment. Positive or negative news, rumors, and discussions on these platforms can quickly influence the sentiment of investors and subsequently impact the price of Bitcoin.

-

News and Media Coverage: Media outlets and news websites often have a profound impact on market sentiment. Positive or negative news stories about Bitcoin, whether related to regulatory developments, technological advancements, or price movements, can sway investor sentiment and lead to increased volatility in the market.

-

Regulatory Developments: Regulatory announcements from governments and financial institutions can have a significant impact on market sentiment. Uncertainty surrounding the legality and regulation of Bitcoin can lead to fear and panic selling among investors, contributing to heightened volatility in the cryptocurrency market.

-

Market Manipulation: Market sentiment can also be influenced by market manipulation tactics such as pump and dump schemes, where a group of investors artificially inflate the price of Bitcoin to attract unsuspecting buyers before selling off their